In a bustling economy like India, where consumers make daily transactions involving countless goods and services, encountering a grievance at some point isn't unexpected. Knowing how to navigate the grievance settlement process can transform a frustrating experience into a resolve that restores confidence and satisfaction. This guide sheds light on the essential steps within this process, starting from the moment a consumer identifies an issue, right through to achieving an amicable solution.

The strength of the Consumer Protection Act 2019 provides a robust framework that empowers consumers to seek redressal with relative ease. By clarifying the responsibilities and rights of both providers and consumers themselves, it demands fairness and transparency in resolving disputes. Understanding the procedural steps laid down by this act is key for anyone looking to safeguard their interests effectively.

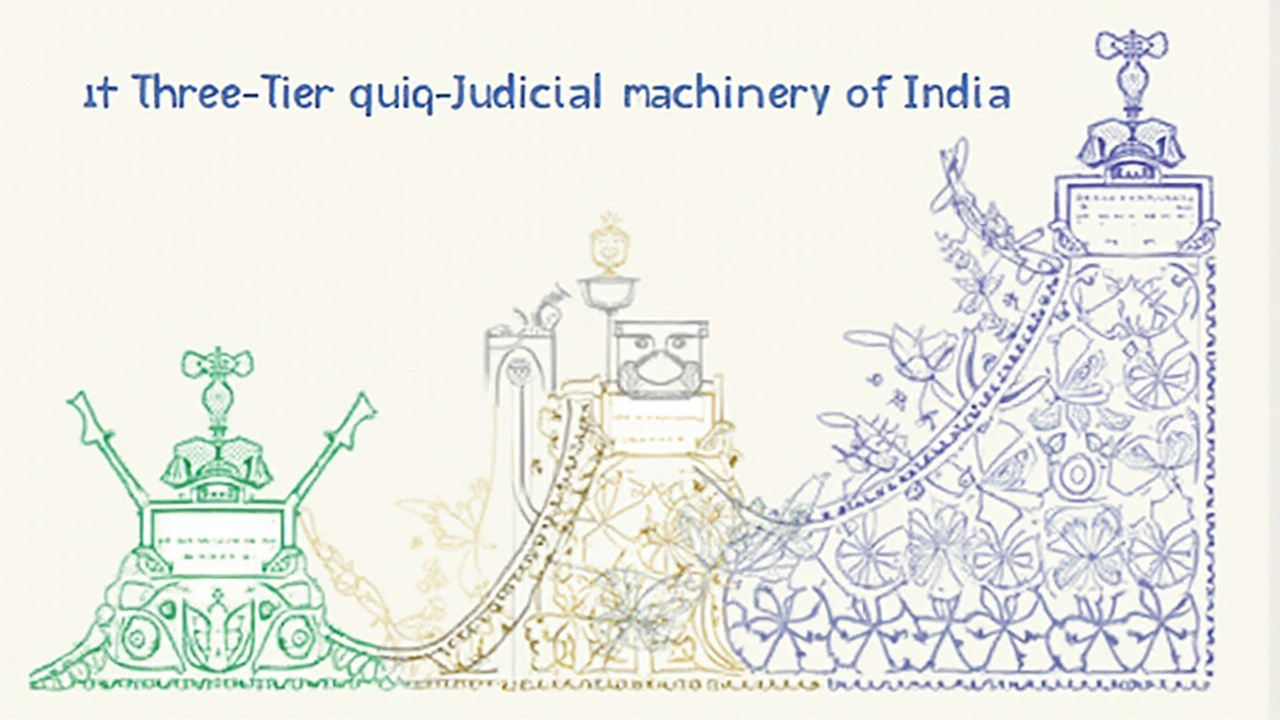

There is also the three-tier structure of the consumer disputes redressal system, which functions at district, state, and national levels. Each tier is designed to handle grievances based on the value of the claim, offering a balanced mechanism for justice. Whether you're taking preliminary steps or approaching higher commissions, this article aims to equip you with all the right tools.

- Initiating a Complaint

- Consumer Protection Act 2019 and Its Impacts

- Navigating Consumer Disputes Redressal Commissions

- Practical Tips for Consumers

Initiating a Complaint

Embarking on the journey of resolving a consumer grievance in India begins with the critical step of initiating a complaint. This process acts as the foundation upon which the entire grievance redressal mechanism stands. To start, a consumer must be aware of their rights as laid out in the Consumer Protection Act 2019. This act serves as a beacon for consumers, shielding them from unfair trade practices and providing a structured path to seek justice.

The first stride in lodging a complaint is to approach the service provider or seller. It is essential for consumers to keep a thorough record of all transactions and communications related to the issue. Documenting every detail can not only strengthen the consumer's case but also serve as an evidential base during formal proceedings. Often, a written complaint to the company's customer service can lead to a satisfactory resolution. If this initial approach doesn't result in a satisfactory resolution, the consumer can escalate the complaint to higher authorities.

In the scenario where direct resolution fails, the next step involves taking the issue to a Consumer Disputes Redressal Commission. Depending on the nature and amount of the dispute, consumers can reach out to district, state, or national level commissions. Key documents required typically include proof of purchase, service agreements, and the correspondence with the seller. A noteworthy point here is the pecuniary jurisdiction, which classifies which commission will handle your case based on the claim's value. A district commission deals with claims up to ₹1 crore, a state commission up to ₹10 crore, and the national commission handles more significant amounts.

It’s useful to note that the Consumer Protection Act also introduced the concept of e-filing complaints, making it more accessible for consumers to lodge complaints without needing physical presence. This step marks a significant leap towards more inclusive consumer rights enforcement. According to a report from the Indian Ministry of Consumer Affairs, approximately 60% of complaints in recent years have been initiated online, showcasing a positive trend towards technological integration in judicial procedures.

The Role of Alternative Dispute Resolution

For faster resolution, consumers might consider engaging in Alternative Dispute Resolution (ADR) methods like mediation. ADR serves as a less formal mechanism, often resulting in a quicker settlement than the formal route through consumer courts. It empowers both parties to resolve disputes amicably without the adversarial nature of a courtroom battle. A study by the Centre for Consumer Studies suggests that nearly 75% of cases resolved through mediation reach a settlement that satisfies both parties, highlighting the system's efficacy.

To wrap it up, successfully initiating a complaint involves understanding one's rights, gathering necessary documentation, and deciding on the most suitable forum for resolution. The process might appear daunting at first, but equipped with the right tools and knowledge, consumers can navigate their way towards a fair resolution. As the famous saying goes, "Justice delayed is justice denied"; thus, acting promptly and efficiently is crucial in the pursuit of consumer justice.

Consumer Protection Act 2019 and Its Impacts

The Consumer Protection Act 2019 marks a significant milestone in Indian consumer law, designed to bolster consumer rights and resolve grievances effectively. This legislation replaces the earlier Consumer Protection Act of 1986 with a more robust, updated framework that reflects the complexities of modern commerce, including the digital marketplace. It recognizes the need for rapid redressal of consumer complaints and the protection against unfair trade practices, defining explicit rights and laying down responsibilities for all parties involved.

An important feature of this law is the introduction of the Central Consumer Protection Authority (CCPA), a regulatory authority with powers to investigate, recall, refund, and impose penalties on manufacturers and companies. This is a game changer for enforcing consumer rights as it provides an authoritative body focused on consumer interests. The Act identifies several unfair practices, such as improper representation of goods or services, which can harm consumers, and prescribes penalties that act as a deterrent for businesses. By doing so, it strives to nurture a fair market landscape.

Another key enhancement is the inclusion of provisions related to e-commerce. In an era where online shopping is spiking dramatically, regulating e-commerce is crucial. The Act mandates that e-commerce entities disclose all pertinent information required by consumers, ensuring transparency comparable to brick-and-mortar stores. The ability to protect consumers in this rapidly changing digital landscape is undoubtedly one of the pivotal impacts of this act.

To highlight the Act's efficacy, consider the inclusion of product liability clauses. These clauses hold manufacturers or sellers accountable for any injury caused by defective products, offering redressal in case of any harm. This instills greater accountability among producers and safeguards consumer interests more vigorously than ever before. "The Act is a landmark in recognizing the rights of consumers, reflecting the economic and technological advancements our society has made," says Anupam Singh, an advocate specializing in consumer law.

"The 2019 Act has indeed heightened the awareness and access to remedies for every consumer, irrespective of their geographical location," Anupam Singh affirms.Such provisions indicate a significant shift towards a more informed and empowered consumer base.

Moreover, the new law introduces the concept of 'mediation' for dispute resolution. This is a voluntary process, encouraging both parties to arrive at a consensual settlement. As part of the three-tier redressal mechanism, mediation offers a less contentious route to conflict resolution, which is particularly beneficial in reducing the time and resources expended in traditional courtroom battles. Statistics from the Ministry of Consumer Affairs suggest that mediation has successfully resolved approximately 70% of the cases since its implementation, underlining its effectiveness.

Overall, the Consumer Protection Act 2019 has significantly impacted the landscape of consumer rights in India, paving the way for a more accountable and fair consumer marketplace. Its progressive elements not only offer solutions to traditional complaints but also equip consumers to face modern market challenges confidently. This extensive legislation reaffirms the nation's commitment to consumer protection and justice, ensuring that the balance of power leans towards those it is meant to serve—the consumers.

Navigating Consumer Disputes Redressal Commissions

The Consumer Disputes Redressal Commissions in India play a vital role in resolving conflicts between consumers and sellers or service providers. These commissions are structured in a three-tier system that includes District, State, and National levels, offering a streamlined approach to handle disputes based on the value involved. The district commission handles cases where the claim does not exceed ₹1 crore, while the state level takes cases from ₹1 crore to ₹10 crore. For claims above ₹10 crore, the National Commission steps in. This separation ensures that cases are handled efficiently, reducing delays and distributing workloads appropriately across various levels.

It’s crucial to understand the procedural steps before lodging a complaint with any of these commissions. Initially, the consumer is required to file a complaint with the appropriate commission by providing all necessary documents and evidence. This includes proof of purchase, warranty documents, and any prior correspondence with the opposite party, among others. Once the complaint is filed, the commission will examine whether it is fit for admission. If admitted, both parties are informed, and a notice is issued for appearance and submission of their case.

The process within these commissions encourages both the consumer and the provider to reach an amicable settlement through mediation. This phase highlights the significant advantage of the Consumer Protection Act 2019, which places a strong emphasis on resolving disputes outside the traditional court system to save time and resources. If a settlement is not achieved, the case is taken up for detailed hearing.

The hearing process varies slightly depending on the tier but fundamentally involves submission of written arguments, presentation of evidence, and examination of witnesses if needed. It's this very structure and methodology that ensures a fair opportunity for both parties to represent their cases fully. A final ruling or order is made based on merits and facts after thorough consideration, allowing for appeals to higher commissions if necessary.

According to Supreme Court Advocate Aman Chaudhari, "The consumer commissions offer an approachable and effective legal remedy to the common man, enhancing consumer confidence across the board."

Complaints need to be precise and supported with strong evidence, making the consumer's role active throughout the proceedings. Often, understanding legal terms and procedures can deepen the engagement and potentially expedite processes. Facts like around 50% of consumer disputes in India are resolved within three to six months when handled through these channels, compared to traditional courts which can take years, underscore the efficiency of these commissions. When deciding which commission to approach, consumers must be clear about the monetary value of their grievance, ensuring the right commission is selected. Persistence paired with the right documentation can lead to successful resolution.

Practical Tips for Consumers

When facing a consumer grievance, the first step is to stay calm and strategic. The consumer rights India framework is designed to protect your interests, so understanding your rights is key. Begin by gathering all relevant documents such as purchase receipts, warranty cards, and any previous communication with the seller. Documenting every interaction helps create a coherent narrative of your grievance. An organized file of evidence significantly aids in presenting a solid case, whether you're communicating with a seller or preparing for a hearing at the consumer disputes commission.

One of the underrated yet effective approaches is to directly approach the company or retailer and express your grievance politely and firmly. Always aim to resolve the issue at the first point of contact, which can save you time and stress. Use email as it provides a written record of your communication. Many companies have dedicated grievance officers or teams to handle consumer complaints, and sometimes issues can be resolved quickly if approached correctly.

If direct communication doesn't yield a satisfactory response, the next step is to formally file a complaint with the Consumer Disputes Redressal Commission. Before you proceed, research whether your issue is eligible to be addressed under the Consumer Protection Act 2019. This act covers deficiencies in service, unfair trade practices, and defective goods, among others. Double-checking the eligibility ensures that you’re taking appropriate action and not wasting your time on claims that don’t fall under the act’s purview.

When preparing your complaint, detail the issue and how it has affected you. Include all the documented evidence and correspondence. Structure your complaint logically—beginning with a summary, followed by supporting details, and a concluding statement that clearly mentions the compensation or remedy you’re seeking. A well-crafted complaint is more likely to gain attention and be taken seriously by the redressal commission or any third-party mediator.

Engaging a consumer rights group or an independent consumer protection organization can provide additional support. These organizations often offer guidance, help mediate between you and the company, or even represent you in the commission if required. Networking with others facing similar issues can offer new perspectives or strategies that you may not have considered initially. Their experience might provide insights into the nuances of the grievance redressal process.

According to a recent study by the Consumer Unity & Trust Society, "Around 65% of consumer grievances at the district level are resolved when a well-documented complaint is filed."This statistic highlights the importance of thorough preparation when dealing with consumer issues. Additionally, adopting a proactive approach to understanding your consumer rights can prevent future grievances. Regularly educating yourself about the evolving consumer laws in India can equip you with the knowledge to handle disputes effectively. Consider it a small investment of time that can potentially save you from significant future hassle.